We are a financial technology firm founded in 2014 by a group of professionals from varied backgrounds, ranging from financial advisory and econometrical research to computer science. Our objective is to apply the latest developments in the fields of artificial intelligence and machine learning to the processes of screening, analysis and selection of financial instruments, and fully digitalize the creation of efficient portfolios.

In our many years of activity, we have provided our services to some of the largest asset management companies in Europe, and we are proud to say that our innovative, fully-digitalized platform has never fallen short of fulfilling the needs of our clients. The investment funds that are managed in accordance with the analysis and insight it provides rank consistently among the CityWire European Top Five, and never fail to deliver on their promises of profitability and stability.

In a world where information is overabundant and overwhelming, and the focus of public attention switches from one macroeconomic variable to another technical indicator in a matter of minutes, even the savviest of wealth managers needs a little help making sense of it all. That is where we come into play.

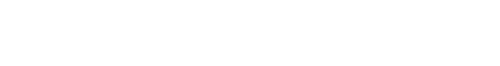

Our EQS Power Selection lines are weighted portfolio compositions, built using our proprietary, fully-automated F.I.R.S.T. technology.

Our highly sophisticated fintech models keep track of hundreds of macroeconomic variables, analyze the fundamentals of thousands of companies worldwide, and monitor global market trends all day every day. Our robots screen companies and classify them, our machine learning engines analyze them, and our AI-driven algorithms rank them and then select the most promising ones. Business sustainability, growth potential, value for investment and war-proof fundamentals are what an EQS Power Selection is all about.

We are dedicated to giving all asset managers a good reason not to invest in yet another ETF: by following the strategic insight our platform provides, anyone can beat the market. The largest investment banks in the world already take full advantage of these technologies and of their incredible potential: we believe everyone should be given access to them.

our products

We always strive to reach farther. It is in our nature to do so. And today, we offer everyone the possibility of accessing our top-tier technology to make informed and effective investment decisions. In finance, the playground is not leveled: large institutions exploit the latest advancements in financial technology to generate ever greater margins and keep an edge on all other actors in the market. Our EQS Power Selections do just that: they level the playground.

The World Equity Selection (WES) that kickstarted our business and made our brand renowned in the circles of asset managers and professional investors. The forty stocks everyone should have in their portfolio at any given time. Learn more…

The Special Opportunities Selection (SO) that identifies the best companies in the market that have recently had a downturn, but also show the most promising prospects of making a comeback. A high-reward product line to support and invest in resilient businesses. Learn more…

Our Optimal Allocation (Opt.A) product line, designed expressly to offer the most consistent performance by applying sound diversification criteria. An all-encompassing balanced selection that includes stocks, bonds, precious metals and real estate. Learn more…

The European Equity Selection (EU) that takes advantage of all our expertise to outperform all regional stock market indices. The perfect addition to an NA-centered portfolio. Learn more…

Our EQS Power Selections come with a vast array of highly detailed reports on historical and current performance, allocation, risk exposure, and much more. No wealth manager who has worked with our reporting instruments has ever been left wanting: when a glance at a webpage is all it takes to know exactly every last detail of one of our Power Selections, it’s hard to be disappointed.